Three Ways To Better Manage Your Finances

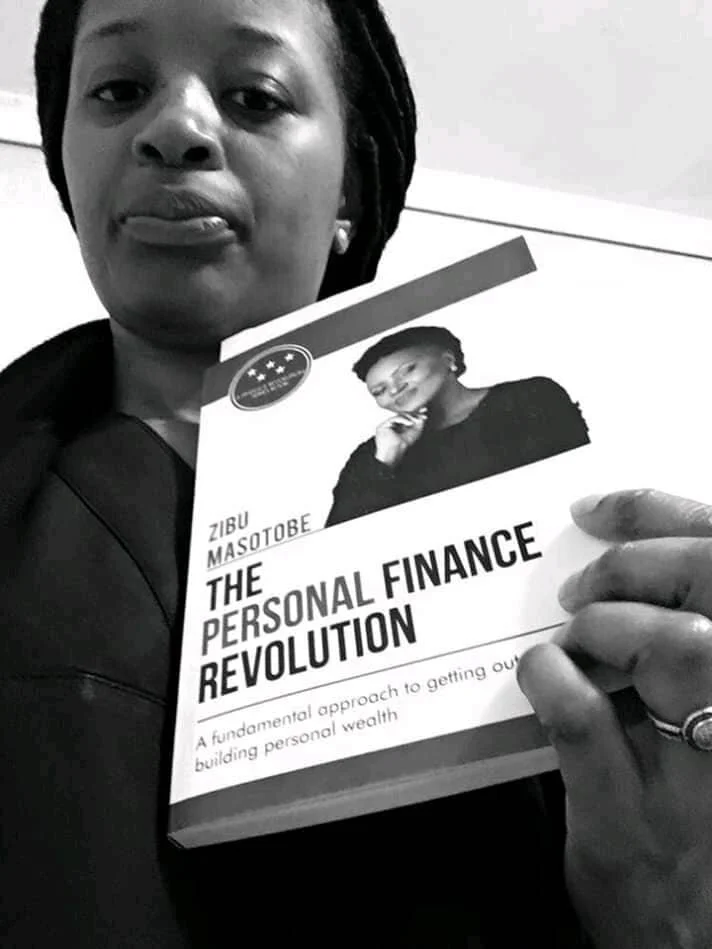

In the Facebook Live discussion “Making Sound Financial Decisions,” hosted by the U.S. Embassy in South Africa, Zibu MaSotobe, an author, international speaker and businesswoman, spoke to the importance of financial literacy, both within the country and across the continent, before taking audience questions about saving, investing and preparing for the future. The following are her recommendations for others looking to better manage their finances now and for years to come.

1. Understand Your Financial Situation

For Zibu, achieving financial independence started with a close assessment of her finances.

“You have to know your financial position,” Zibu said. “How exposed is your household to debt? Do you have insurance in place?”

“I want people to get a perspective on what’s happening. I want them to know where they stand,” Zibu said. “Are they using debt to numb an emotional pain, for instance?”

Here Zibu recommended booking an assessment with a financial adviser or institution to understand where your money is going and how to best prepare for an often uncertain future.

2. Spend And Save Wisely

With a clear understanding of your financial standing, the next step is to adjust how you spend your money, Zibu said, as this will determine your financial future.

“Ask yourself before every purchase: Do I want this or do I need this? Is it urgent or can it wait?” Zibu said. “Can you afford it without credit?”

In some cases, monitoring your spending can reveal where you or others in your household can greatly reduce your expenses.

“Should you downsize to cut down on your rent, car and other expenses?” Zibu asked, posing additional questions to listeners looking to better manage their debt.

Crucially, Zibu insisted that listeners get their finances in order before sharing their wealth with others, demands from family and friends notwithstanding.

“You need to secure your own financial future before you start assisting others in the same way that you put your oxygen mask on first before helping others,” Zibu said.

3. Share What You’ve Learned

For Zibu, financial literacy is a skill to be passed on.

“Once you get your debt in order, you need to teach others,” Zibu said. “We have to start teaching others early what we learned late.”

“Be the kind of parent that leaves a legacy,” Zibu said. “What are you leaving for the next generation?”

Zibu closed the session recounting her early years witnessing the great disparity around her in South Africa.

“Black women are the majority in South Africa, but we are also the economic minority,” Zibu said. “We need to get into business; we need to raise girls who are proud.”

“It’s not about buying the biggest house,” Zibu said. “It’s about being the kind of woman who leaves this country in a better place than she found it.”

To explore more resources, visit our Resources Page.

The views and opinions expressed here belong to the author or interviewee and do not necessarily reflect those of The Youth Cafe.